Compound roth ira calculator

Traditional or Rollover Your 401k Today. Find a Dedicated Financial Advisor Now.

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Ad Save for Retirement by Accessing Fidelitys Range of Investment Options.

. Build Your Future With a Firm that has 85 Years of Retirement Experience. But by depositing an additional 100 each. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Roth IRA or 401k is a super-efficient saving. Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest. Roth IRA Retirement Calculator.

Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings. The amount you will contribute to your Roth IRA each year. It is important to note that this is the maximum total contributed to all of your IRA accounts.

Unlike taxable investment accounts you cant put an. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Heres a comparison of one deposit of 1000 and different rates of compounding interest even if you didnt continue to add to the Roth IRA account.

Wed suggest using that as your primary retirement account. A Roth IRA is totally useless if you dont invest the money in your Roth IRA. Your money earns interest every day if it.

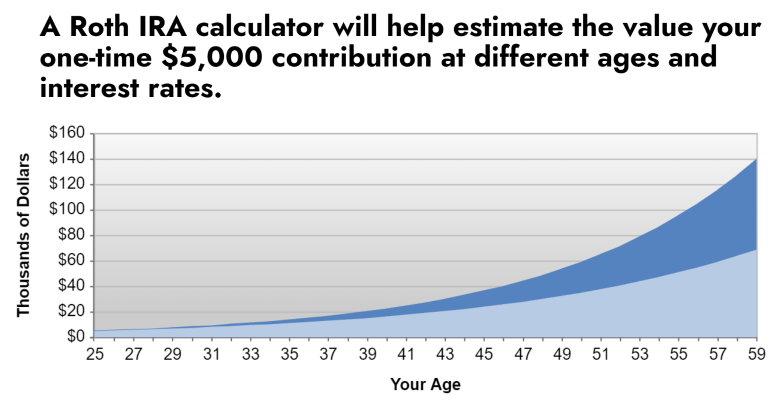

Explore Choices For Your IRA Now. This calculator lets you see how a Roth IRA will fit into your own plans. Do Your Investments Align with Your Goals.

A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. It is important to.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Not everyone is eligible to contribute this. Ad Open an IRA Explore Roth vs.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

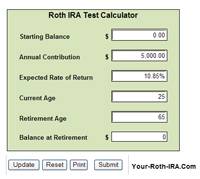

Compound Interest Calculator Roth Ira A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. This calculator assumes that you make your contribution at the beginning of each year. For 2019 the maximum annual IRA contribution of 6000 is an increase of 500 from 2018.

For 2022 the maximum annual IRA. Find a Dedicated Financial Advisor Now. Ad Explore Your Choices For Your IRA.

Below the top location for financial education Im mosting likely to review 3 of the most effective Roth IRA. If you have a 401k or other retirement plan at work. You can contribute up to 20500 in 2022 with an additional.

We started with 10000 and ended up with a little more than 500 in interest after 10 years in an account with a 050 annual yield. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. You can easily perform this calculation using our Compound Interest Calculator Roth IRA.

The Roth 401 k allows contributions to. This calculator assumes that you make your contribution at the beginning of each year. How to Calculate Compounded Interest in a Roth IRA.

Get Up To 600 When Funding A New IRA. For comparison purposes Roth IRA and regular taxable. Ideally you should contribute up to the limit while youre working in order to maximize.

Traditional and Roth IRAs give you options for managing taxes on your retirement investments. Calculate your earnings and more. A 401 k can be an effective retirement tool.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. Do Your Investments Align with Your Goals. Roth Conversion Calculator Methodology General Context.

Get Up To 600 When Funding A New IRA.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Roth Ira For Millennials And Gen Z Wouch Maloney Cpas Business Advisors

Roth Ira Calculators

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Roth Ira Calculator Calculate Tax Free Amount At Retirement

What Is The Best Roth Ira Calculator District Capital Management

Best Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The Best Roth Ira Calculator District Capital Management

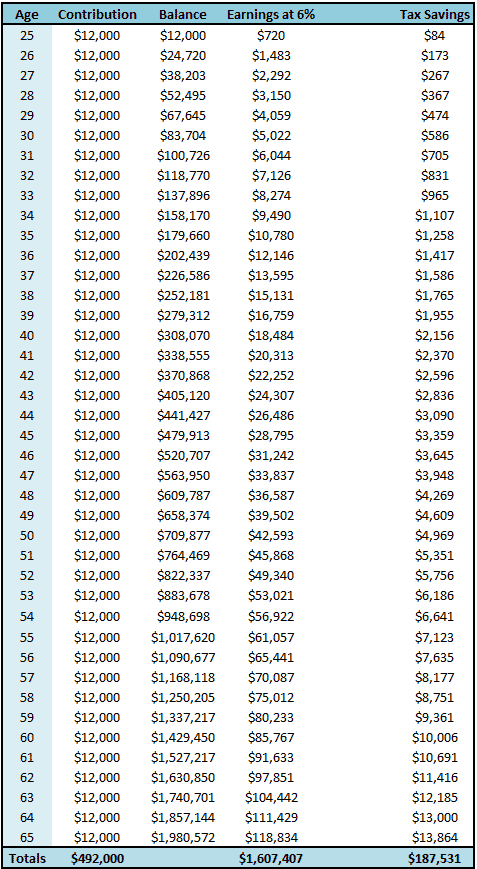

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Roth Ira Calculator Roth Ira Contribution

Download Roth Ira Calculator Excel Template Exceldatapro